The mechanism for collecting value added tax fines for imported items was announced at the customs

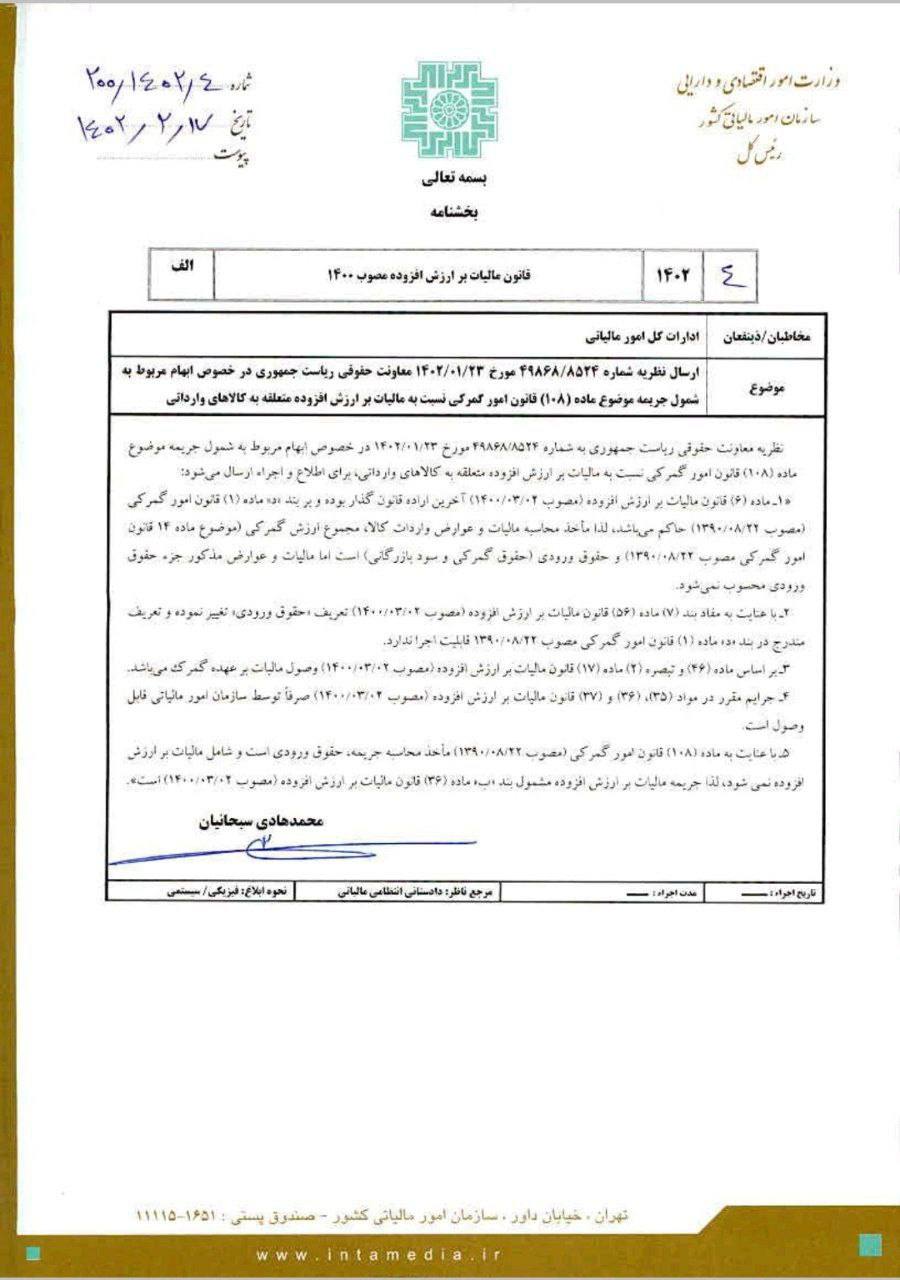

Circular No. 8524/49868 dated 1/23/1402 of the Presidential Legal Office regarding the ambiguity related to the inclusion of the fine under Article 108 of the Customs Law regarding the value added tax on imported goods.

It is stated in the circular of the head of tax affairs, the theory of the presidential legal assistant number 8524/49868 dated 1/23/1402 regarding the ambiguity related to the inclusion of the fine subject to Article (108) of the Customs Law regarding the value added tax belonging to imported goods. It is sent for information and implementation.

Article 6 of the Value Added Tax Law approved on 2/3/1400 is the last will of the legislator and it governs paragraph d of Article 1 of the Law on Customs Affairs approved on 22/8/1390. Therefore, the basis for calculating taxes and duties on goods imports is the total customs value (the subject of Article 14 of the Law on Customs Affairs approved on 8/22/1390) and import duties (customs duties and commercial interest), but the mentioned taxes and duties are not considered part of import duties.

With regard to Clause 7 of Article 56 of the Value Added Tax Law, the definition of input rights has been changed and the definition contained in Clause D of Article 1 of the Customs Law is not enforceable.

According to Article 46 and Note 2 of Article 17 of the Value Added Tax Law, tax collection is the responsibility of customs.

The crimes stipulated in Articles 35, 36 and 37 of the Value Added Tax Law can only be collected by the Tax Administration.

According to Article 18 of the Customs Law, the basis for calculating the fine is the import duty and does not include the value added tax, therefore, the value added tax fine is included in Article 36 B of the Value Added Tax Law./Tasnim

This post is written by shadmanamini