Central Bank announced the exemption of issuing guarantees, opening letters of credit and some banking facilities from receiving tax certificates.

The payment of facilities above 2 billion Rials to natural persons and 5 billion Rials to legal persons was subject to the provisions of Note 1 of Article (186) of the Direct Taxes Law.

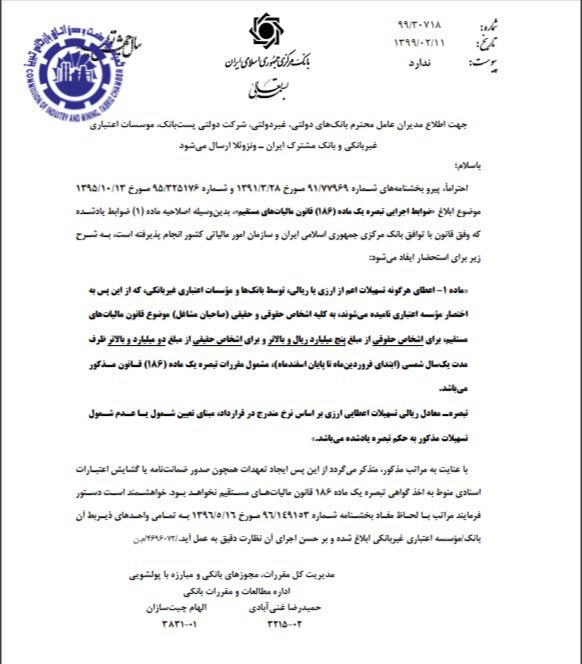

By issuing a circular, the Central Bank amended Article 1 of the Executive Regulations, Note 1 of Article (186) of the Direct Taxes Law.

According to this circular, the granting of any facilities, whether in foreign currency or Rials, by banks and non-bank credit institutions to all legal and natural persons (business owners) subject to the Direct Taxes Law, for legal persons from the amount of 5 billion Rials and above and for natural persons from the amount of 2 billion Rials and above within one calendar year (from the beginning of April to the end of March), will be subject to the provisions of note one of article (186) of the said law.

Based on this, the Riyal equivalent of foreign exchange facilities based on the rate specified in the contract is the basis for determining the inclusion or exclusion of the mentioned facilities according to the ruling of the note.

In this circular, Central Bank also emphasized that from now on, the creation of obligations such as issuing guarantees or opening letters of credit will not be subject to obtaining the certificate of Note 1 of Article 186 of Direct Taxes Law.

It should be mentioned that according to Note 1 of Article 186 of the Law on Direct Taxes, the granting of banking facilities to legal entities and business owners by banks and other credit institutions will be subject to obtaining the following certificates:

1. Payment certificate or tax debt payment arrangement has been confirmed.

2. The certificate of the relevant tax affairs department confirming the receipt of a copy of the financial statements submitted to banks and other credit institutions.

The implementation rules of this note will be determined and communicated by the country’s tax affairs organization and the central bank of the Islamic Republic of Iran.

circular