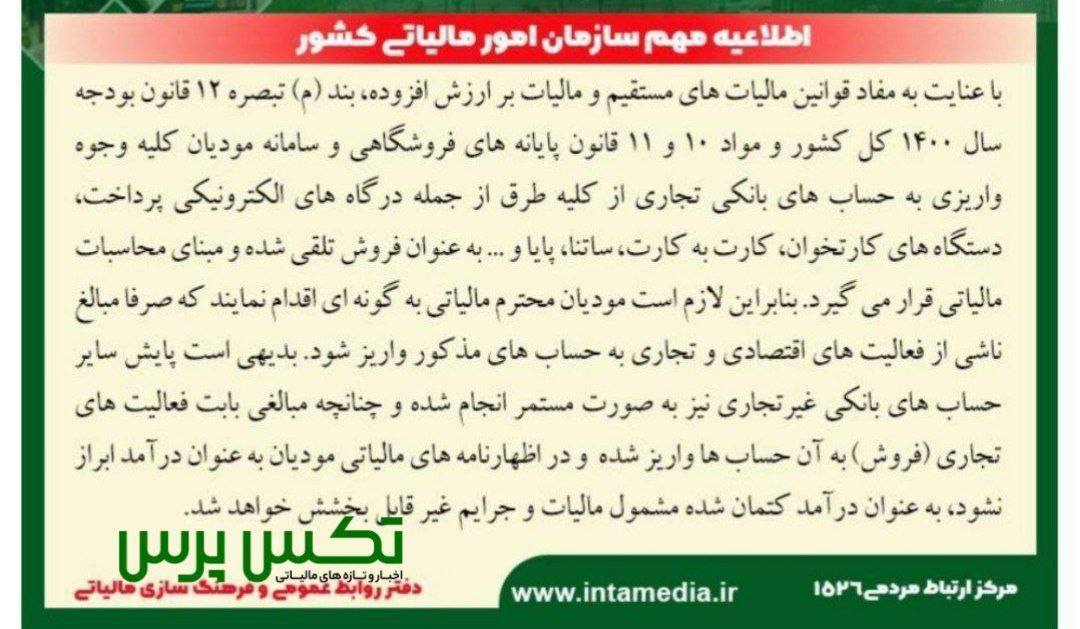

Important announcement of the Tax Administration

According to the existing laws and regulations, all funds deposited into commercial bank accounts through all methods, including electronic payment gateways, card readers, card-to-card, Satna, Paya, etc. It is considered as a sale and is the basis of tax calculations.

Taxpayers should pay attention to act in such a way that only the amounts resulting from economic and commercial activities are deposited into the mentioned accounts.

It is obvious that non-commercial bank accounts are continuously monitored and if amounts are deposited into them for commercial activities and not declared in tax returns, the income will be considered hidden and subject to taxes and related crimes.

More briefly:

If you do not have an engineering service activity and you make transactions with a commercial account (an account that you have introduced to the tax office), you will be subject to tax.

So, if you don’t do monitoring/implementation/design work, don’t work with your business account at all

#tax

The channel of moderators, presenters and top designers

This post is written by rezasangsarii