Lessons from direct tax law

When we read the technical-engineering laws (municipal law + building control and engineering system law + housing production and supply support law + law on the right of free access to the rail network, etc.), a common weakness can be seen in all of them: weak criminalization and the judicial process. weaker

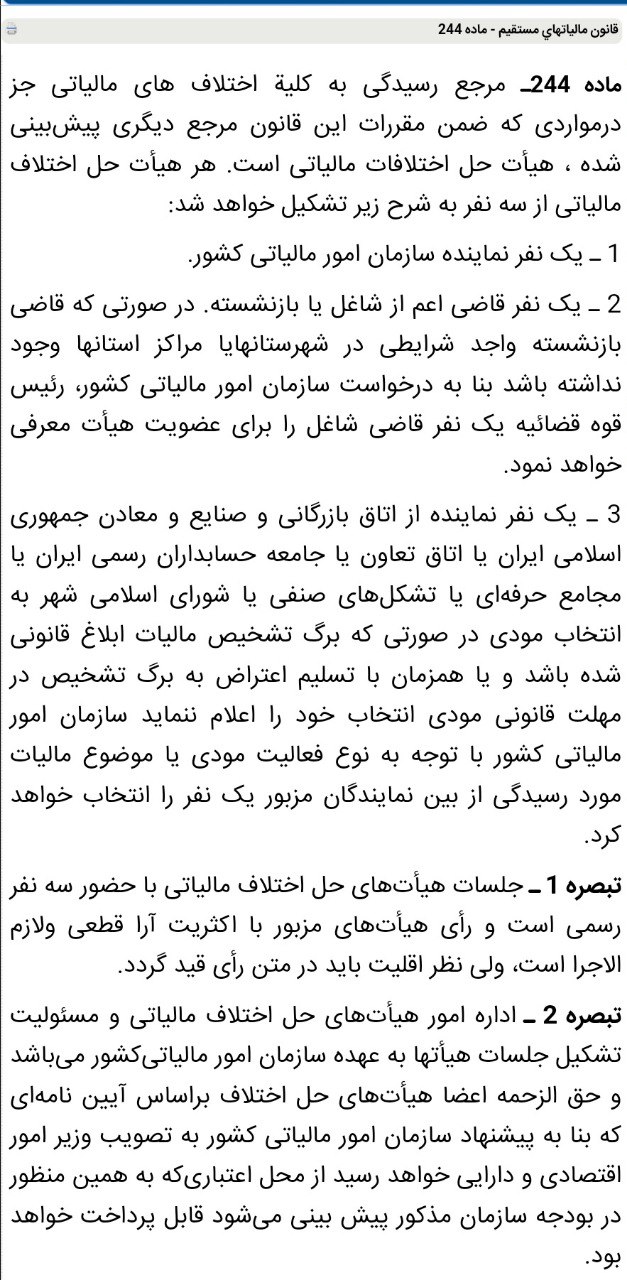

The formality of the meetings of the Disciplinary Council (Article 24 of the Law on Engineering and Building Control, of course, is clearly stated) has always been controversial. If we look at Article 244 of the Direct Tax Law, we will only have to eat a cup.

It is important that the number of attendees is accurate for the formality of the meeting (Note 1 of Article 244) + Writing the minority opinion in the text of the vote (Note 1 of Article 244) + How to pay the lawyer’s fee to cut off the financial relationship with the Tax Administration to establish his impartiality (Note 2) Article 244) should be eaten. It is interesting to know that if the meeting is not official, Modi can demand the cancellation of the meeting.

Now, the people who showed us step by step in the preparation of the instructions intend to go through the process of preparing the law without the presence of engineers.

#administrative_council

#Amendment_of_the_law

Abolfazl Tabarzadi

Member of the Organization of Construction Engineering System of Khuzestan Province

The link of Pragmatic Engineers channel

@Amalgaraa

This post is written by AbolfazlTabarzady