Understanding the concept of #crack_spread:

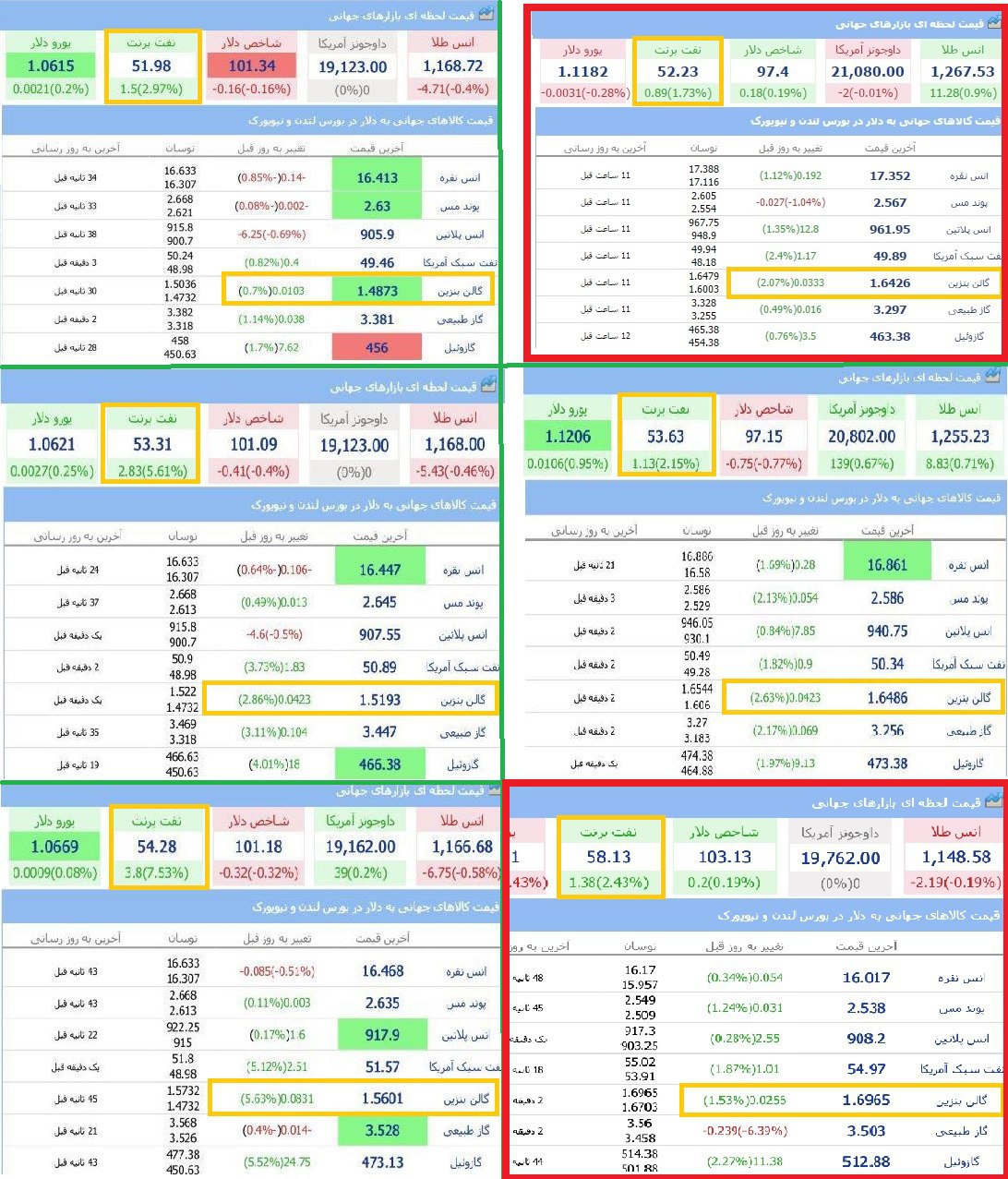

In the picture below, you can see the price of crude oil and gasoline at different prices. As you can see, oil price changes are not the same as gasoline and other products like diesel.

As I mentioned in the previous articles in this regard, what is effective in the profit of refineries is not the high price of oil, but the distance between the price of the product and the price of oil. If you look carefully at the picture below, you can see that the price of gasoline in $52.23 oil is equal to 1.6426 per gallon and in $58.13 oil it is equal to 1.6965. That is, the difference between these two gasoline prices is 0.0539 dollars, that is, about 5 cents per gallon, but the difference between the oil purchased on the same day is 5.9 dollars. That is, it is true that the price of oil is more expensive at $58.13 and many people are looking for an increase in the price of oil, but the difference in gasoline is about 5 cents. But for these 5 cents, the refinery has to buy nearly 6 dollars more expensive oil per barrel.

This means that a refinery earns more profit at $52.23 oil.

This difference between the price of the product and the feed is the crack spread. One of the important topics of the refining industry around the world is the sensitivity of the profit of this industry to the fluctuations of the crude oil price and the change in the spread of various refining products, which contrary to popular belief, the change in the price of oil does not necessarily have an immediate effect on the spread. However, after establishing peace and relative stability in the oil market, crack spreads adjust their distance to the price of crude oil in accordance with their historical trend.

Another important issue in the growth of profitability of refining companies is the ability to adapt their production operations to the existing crack spreads and the ability to respond to demands that are sometimes seasonal, and companies can quickly step towards the growth of their incomes by changing their production and sales procedures. . For example, the data of the US oil market has shown that in the cold months of the year, crack spreads of products suitable for heating have grown, and the same discussion applies to gas oil in the warm and cool months of the year.

In addition to the mentioned case, what has increased the profitability of Iran’s refineries in the past year; The change in feed price from 95% fob of the Persian Gulf to the average export oil of Iran and the sale of products considering the quality of the fob of the Persian Gulf to the sale of products at the Singapore rate and without considering the quality, this case, in addition to cracking the global spread, causes There has been a very tangible increase in profit in Iranian refineries

So, friends, please note that oil price changes, either in decrease or increase, do not necessarily have a positive or negative effect, and what is important is the ratio of this change to the change in the price of the product.

Hossein Arjalo 7 June 1996

@boursihome

This post is written by Bamiii60